DeepOcean is the first case of the English court sanctioning a restructuring plan with cross-class cramdown under the new Part 26A of the Companies Act 2006.

Click here to access the full article.

Introduction

Schemes of arrangement were introduced to English company law by the Joint Stock Companies Arrangement Act 1870. The statutory provisions, drafted with typical Victorian brevity and elegance, have stood the test of time, providing a flexible framework for the re-arrangement of capital structures for 150 years. But prior to the enactment of the Corporate Insolvency and Governance Act 2020 (“CIGA”), it was not possible for the Court to sanction an arrangement unless each class of creditors 1 to be bound by the scheme voted to approve it by the requisite statutory majorities, including three quarters in value. This means that dissenters holding at least a quarter in a class whose rights are to be affected by an arrangement can veto the scheme as a whole.

The restructuring plan is a new tool available to debtors for the rearrangement of debt and equity, which is not subject to this dissenters’ veto. Inserted by the CIGA in June 2020, Part 26A of the Companies Act 2006 (“Part 26A”) enacts a mechanism based on the scheme, but available only to a debtor in financial difficulties. In such circumstances, the Court has a new power to sanction a binding restructuring plan even where one or more classes of creditors have not voted to approve that plan by the requisite majority in value. But the statutory wording makes plain this power to cram down dissenting classes is subject to checks-and-balances, being both conditional and discretionary. Most importantly, the Court must be satisfied that, if the arrangement were to be sanctioned, the dissenting creditors would not be worse off under the “relevant alternative” (i.e. the alternative most likely to occur if the plan were not sanctioned).

Although DeepOcean was the third case in which a restructuring plan was sanctioned by the Court, it was the first case in which the cross-class cram down mechanism was required 2. It was also the first case in which a restructuring plan has been used to facilitate a solvent wind-down, rather than the rescue of a company as a going concern and the first restructuring plan with a bar date. Trower J’s convening judgment is found at [2020] EWHC 3549 (Ch) and the sanction judgment, also of Trower J, is at [2021] EWHC 138 (Ch). This article looks at the guidance in DeepOcean as to how the Court will approach restructuring plans under Part 26A and, in particular, the exercise of its power to sanction such a plan where this entails a cross-class cram down. References to sections in what follows are to those in the new Part 26A of the Companies Act 2006 which are numbered section 901A to section 901L.

Background

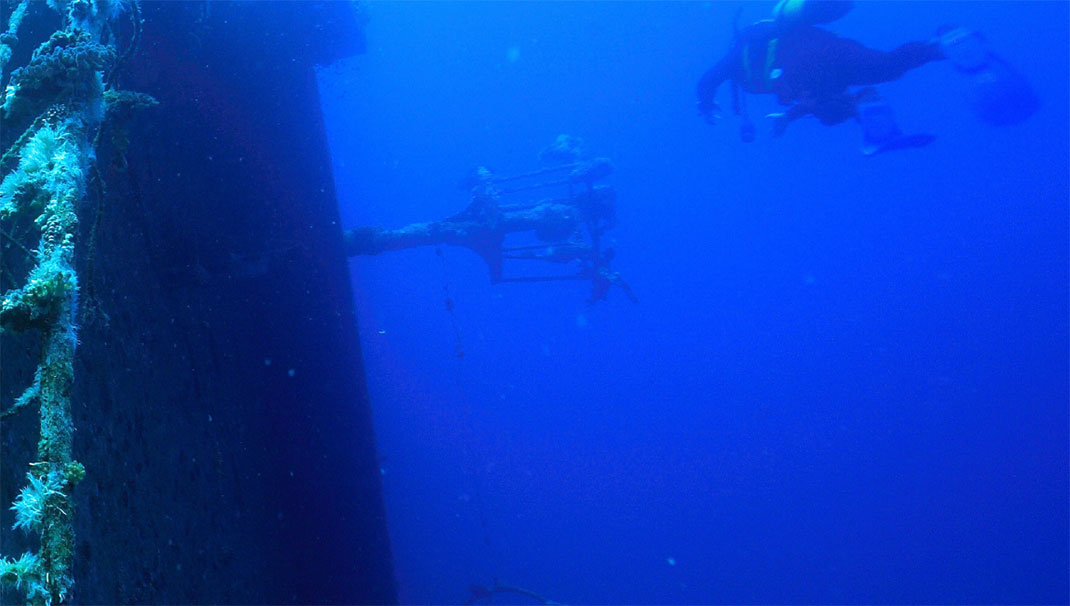

The DeepOcean group is a provider of subsea services around the world. Following a period of financial difficulties, exacerbated by the Covid-19 pandemic, the group launched restructuring plans under Part 26A (the “Plans”) for three UK subsidiaries (abbreviated as DO1, DSC and ES, the “Plan Companies”). The Plan Companies had, for some time, been reliant on funding from the wider group, which no longer considered this viable. That being so, unless the Plans were sanctioned, it was considered that the Plan Companies would go into administration or liquidation (the “Insolvency Scenario”).

Key features of the Plans were that:

(1)Secured creditors would release their claims against the Plan Companies, but retain their rights against wider group companies; and

(2)Unsecured creditors, in return for the extinguishing of their claims, would receive a payment that was approximately 4% better than what they would receive in the Insolvency Scenario, the payments being funded by members of the wider group3.

A bar date for claims submission was set in order to ensure finality 4, with the Plan Companies then to be wound-down on a solvent basis.

Part 26A – The Law

Section 901A sets out thresholds for a restructuring plan. It provides:

“(1) The provisions of this Part apply where conditions A and B are met in relation to a company.

(2) Condition A is that the company has encountered, or is likely to encounter, financial difficulties that are affecting, or will or may affect, its ability to carry on business as a going concern.

(3) Condition B is that – (a) a compromise or arrangement is proposed between the company and- (i) its creditors, or any class of them, or (ii) its members, or any class of them, and (b) the purpose of the compromise or arrangement is to eliminate, reduce or prevent, or mitigate the effect of, any of the financial difficulties mentioned in subsection (2).

(4) In this Part … ‘company’ … means any company liable to be wound up under the Insolvency Act 1986 …”

Where the requirements of section 901A are met, the court is empowered by section 901C to order a meeting or meetings of creditors (in language which mirrors the language of section 896(1) in relation to schemes under Part 26).

Section 901F provides that if a number representing 75% in value of the creditors or class of creditors or members or class of members (as the case may be), present and voting either in person or by proxy at the meeting summoned under section 901C, agree a compromise or arrangement, the court may, on an application under that section, sanction the compromise or arrangement. Unlike with schemes of arrangement, there is no additional requirement that 50% by number of the class vote in favour.

Even if a restructuring plan is not approved by one or more classes of creditors or members, the plan does not automatically fail, as would a scheme, but can still be sanctioned by the Court under section 901F if two additional requirements set out in section 901G are met. This is described in the Explanatory Notes to CIGA as a cross-class cram down. Section 901G, a key provision, says:

“(1) This section applies if the compromise or arrangement is not agreed by a number representing at least 75% in value of a class of creditors or (as the case may be) of members of the company (“the dissenting class”), present and voting either in person or by proxy at the meeting summoned under section 901C.

(2) If conditions A and B are met, the fact that the dissenting class has not agreed to the compromise or arrangement does not prevent the court from sanctioning it under section 901F.

3)Condition A is that the court is satisfied that, if the compromise or arrangement were to be sanctioned under section 901F, none of the members of the dissenting class would be any worse off than they would be in the event of the relevant alternative (see subsection (4)).

(4) For the purposes of this section “the relevant alternative” is whatever the court considers would be most likely to occur in relation to the company if the compromise or arrangement were not sanctioned under section 901F.

(5) Condition B is that the compromise or arrangement has been agreed by a number representing 75% in value of a class of creditors or (as the case may be) of members, present and voting either in person or by proxy at the meeting summoned under section 901C, who would receive a payment, or have a genuine economic interest in the company, in the event of the relevant alternative…”

The additional jurisdictional conditions that must be satisfied for a cross-class cramdown are therefore that (i) if the plan is sanctioned, none of the members of the dissenting class would be any worse off than they would be in the event of the relevant alternative; and (ii) the plan has been approved by at least one class of creditors or members who would have a genuine economic interest in the company in the relevant alternative.

The relevant alternative is defined as “whatever the Court considers would be most likely to occur in relation to the company if the compromise or arrangement were not sanctioned”: see section 901G(4). The relevant alternative is broadly similar to the concept of the “comparator” to a scheme (which has been developed in the case law under Part 26). In DeepOcean’s case the relevant alternative was the Insolvency Scenario.

Issues at the convening hearing

Jurisdiction

The jurisdictional issues familiar from the scheme context were relatively straightforward in this case. The Plan Companies were companies liable to be wound up under the Insolvency Act 1986 and therefore companies in respect of which the jurisdiction to sanction restructuring plans was available: see section 901A(4). Trower J was also satisfied that the Recast Judgments Regulation (EC/1215/2012), potentially relevant because the proceedings were issued before the end of the transition period 5, was not an impediment to the Court’s jurisdiction as a substantial number of Plan creditors were domiciled in the United Kingdom such that Article 8, if relevant, could be relied upon 6.

“On the question of whether the purpose of the Plans was to eliminate, reduce, prevent, or mitigate the effect of any of the Plan Companies’ financial difficulties, the fact the Plans would result in a better return to Plan creditors than in the relevant alternative was considered to amount to mitigation of the effect of the financial difficulties.”

As noted above, before Part 26A CA06 can apply in relation to a company it must, however, also be shown that the company has encountered or is likely to encounter financial difficulties that are affecting, or will, or may affect its ability to carry on business as a going concern and that the purpose of the compromise or arrangement proposed between the company and its creditors, or any class of its creditors, must be to eliminate, reduce, or prevent, or mitigate the effect of any of the financial difficulties mentioned in the description of condition.

Trower J was satisfied that each of the Plan Companies’ financial difficulties meant that it was on the point of becoming unable to carry on business as a going concern. He was also satisfied that the Plans would involve a sufficient amount of give and take to constitute a compromise or arrangement.

On the question of whether the purpose of the Plans was to eliminate, reduce, prevent, or mitigate the effect of any of the Plan Companies’ financial difficulties, the fact the Plans would result in a better return to Plan creditors than in the relevant alternative was considered to amount to mitigation of the effect of the financial difficulties. As to this, Trower J considered that it was not necessary for the Plans to have any effect on the ability of the Plan Companies to carry on business as a going concern. That such an approach would be “too narrow” (at [48]) is supported by the fact that restructuring plans (like schemes) are available even after a company has gone into liquidation (see section 901C(2)(c).

Classes

As in Virgin Atlantic and Pizza Express, the approach in the scheme context was adopted in relation to class constitution. The question was therefore whether the rights of the various groups and categories of creditor were so dissimilar as to make it impossible for them to consult together with a view to their common interest. Applying this approach, Trower J accepted that (i) secured creditors should form one class; (ii) the landlord creditor should form a separate single class in the DO1 Plan (in light of its proprietary rights in property in the possession of DO1 and an entitlement to take steps to forfeit and repossess that property in circumstances of non-payment), (iii) the vessel owner creditors should form a separate single class in the DO1 Plan (in light of their rights as against DO1 to recover the vessels which are the subject of their charterparties); and (iv) the remaining (unsecured) Plan creditors (referred to as the “Other Plan Creditors”) form a single class under each Plan.

Cross-class cramdown at the sanction hearing

The statutory majorities were achieved at each of the Plan meetings save for the DSC Other Plan Creditors’ meeting, where a majority of less than three-quarters in value voted in favour so that the requirements of section 901F(1) were not satisfied. It was therefore necessary for DSC to rely on section 901G to cram down the DSC Other Plan Creditors. This required the Court to consider both the statutory conditions and the scope of the Court’s power.

Requirements of section 901G

First of all, section 901G requires that the Court must be satisfied (A) that if the restructuring plan is sanctioned, none of the members of the dissenting class would be any worse off than they would be in the event of the relevant alternative; and (B) that the restructuring plan has been approved by at least one class of creditors who would have a genuine economic interest in the company in the relevant alternative (section 901G(5)).

As to Condition A, Trower J was satisfied that none of the members of the dissenting class would be any worse off than they would be in the event of the Insolvency Scenario in light of the 4% increase on their estimated return built into the Plans. Valuation disputes are likely to be of far greater significance in other contexts where future cases is the Court’s observation that, whilst the starting point will normally be a comparison of the value of the likely dividend, or the amount of any discount to the par value of each creditor’s debt, the phrase used is “any worse off”, “which is a broad concept and appears to contemplate the need to take into account the impact of the restructuring plan on all incidents of the liability to the creditor concerned, including matters such as timing and the security of any covenant to pay” (at [35]).

As to condition B, DSC’s secured creditors had approved the Plan and the evidence established that they would make a small recovery from the charged assets in the Insolvency Scenario and, while there may be artificiality in some cases in the constitution of classes in order to ensure that the requirements of the section 901G are satisfied, there was no such artificiality in this case.

Trower J also noted that the secured creditors would also make a return from the assets of other group companies in the Insolvency Scenario, but it was not necessary for him to decide whether that alone would have been sufficient.

Discretion

As is made clear by the use of the word “may” in section 901F(1), the court has a discretion whether to sanction a restructuring plan, a point that is emphasised by the Explanatory Notes to CIGA which says the Court “may refuse sanction on the grounds that it would not be just and equitable to do so, even if the conditions in section 901G have been met” (at [192]).

In Virgin Atlantic Snowden J followed the approach established in relation to schemes when determining whether or not to sanction a restructuring plan under Part 26A where section 901G was not engaged (at [51] and [52], referring to the summary of David Richards J in Re Telewest Communications plc (No. 2) [2005] BCC 36 at [20]-[22]). Noting that in the scheme context the Court will be slow to differ from the meeting, unless the class has not been properly consulted, or the meeting has not considered the matter with a view to the interests of the class, or some blot is found in the scheme, Trower J (at [21]) took the view that a slightly different approach was, however, needed where the Court was considering whether to sanction a restructuring plan in circumstances where reliance is placed on section 901G. A cross-class cram down is premised on the Court overriding the decision of a dissenting class.

As to the Court’s approach to its discretion, Trower J indicated that, if the conditions in section 901G are satisfied, then a company will have “a fair wind behind it” in obtaining the Court’s sanction (at [48]). In other words, all other things being equal, satisfaction of conditions A and B is capable of justifying an override of the views of a dissenting class.

As to matters which might be relevant to whether sanction should be refused, Trower J considered that the overall level of support for the Plan Companies’ proposals, together with the question of whether the Plan Creditors were fairly represented at their respective Plan meetings remain relevant questions, whether or not section 901G is engaged. In particular, a low turnout at a dissenting class meeting may impact how much weight is to be given to the fact the requisite majority did not vote in favour.

On the facts:

(1) The turnout at the meetings of the Other Plan Creditors was low (between 25% and 32%), but this was not particularly surprising as the Other Plan Creditors were primarily trade creditors;

(2) Over 99% of total claims against DSC by value voted in favour of the Plan (although given the different nature of the deal for secured creditors this was of limited significance);

(3) 84% by value of all claims by Other Plan Creditors of DO1, ES and DSC voted in favour of the Plans, which was important given that all Other Plan Creditors were to receive the same percentage uplift of their estimated recovery in the Insolvency Scenario.

Notably, the consenting class was fully locked-up, removing some of the doubt as to whether cross-class cram down is available in such circumstances which arose following obiter comments of Snowden J in Virgin Atlantic.

What is also clear from DeepOcean is that the Court will then look at whether a restructuring plan treats creditors differently as between themselves and whether such differential treatment can be justified. This is similar to what is termed a “horizontal comparison” in the context of a challenge to a company voluntary arrangement on the basis that it is unfair. Trower J noted that the Court will be concerned to ascertain whether there has been a fair distribution of the benefits of the restructuring between those classes who have agreed the restructuring plan and those who have not.

On the facts, the differential treatment of DSC’s secured creditors and the Other Plan Creditors was justified by reference to the secured nature of the former’s claims, as well as the fact that the latter were out of the money in the Insolvency Scenario. Trower J also noted that, whilst certain claims had been excluded, the Plan Companies had good commercial reasons for doing so such that differential treatment as between Other Plan Creditors and those excluded creditors was similarly justified

Conclusions

Cross class cramdown is an incremental development in English insolvency law. For well over a century, since at least Re Tea Corp [1904] 1 Ch 12, there have been other techniques for restructuring a company’s indebtedness which can in practice achieve a similar effect to the binding of a dissentient class. A company in financial difficulties might propose a scheme with one or more classes of senior creditors, with the scheme providing for the assets of the company to be transferred to a new entity (usually one owned by the senior creditors, thereby effecting a “debt-for-equity” swap). The company’s junior creditors may be excluded from the scheme altogether (so that they are not entitled to vote at any of the scheme meetings) and left behind with worthless claims against the original company, which will become an empty shell with no assets. This technique effectively operates to remove the junior debt from the finance structure of the business without the consent of the junior creditors 7.

Whilst the Tea Corp technique is a powerful restructuring tool, it has limits. It does not enable any specific restructuring deal to be imposed on the junior creditors as a matter of contract. They are simply left behind with nothing. If the junior creditors are not entirely “out of the money” (but would make a partial recovery if the scheme did not proceed), then it may be difficult or impossible to use the Tea Corp technique to implement a restructuring which binds the junior creditors without their consent. Part 26A fills those gaps 8.

More broadly, the new provisions of Part 26A are important in expanding the scope of what can be achieved by a debtor in a restructuring plan as compared with a scheme. A dissenting creditor, or group of creditors, will not have a veto power on a compromise or arrangement. This in turn may have behavioural consequences, altering both the scope of restructuring negotiations and (potentially) the value of hold-out positions in the debt markets. At the same time, there may well be a shift in the disputes coming before the English court in the restructuring context. Historically, class issues and analysis have been of central importance and will remain so. But valuation disputes are likely to become of at least equal significance as debtors seek to utilise cramdown to override the votes of dissentient classes. DeepOcean is but a first expedition into previously uncharted waters.

Credits:

Tom Smith QC and Charlotte Cooke acted for the Plan Companies

Jeremy Goldring QC and Ryan Perkins acted for the Original Locked Up Lenders

- Or members (if applicable).

- The earlier cases were Re Virgin Atlantic Airways Ltd (see the convening judgment of Trower J [2020] EWHC 2191 (Ch) and the sanction judgment of Snowden J [2020] EWHC 2376 (Ch), both reported at [2020] BCC 997) and Re PizzaExpress Financing 2 plc (see the convening judgment of Sir Alastair Norris [2020] EWHC 2873 (Ch). The sanction judgment has not yet been released).

- Certain claims including employee claims, tax claims and intercompany claims were excluded.

- A bar date was similarly set in the Noble Group scheme of arrangement: [2019] BCC 349.

- See Article 67 of the Withdrawal Agreement.

- However, note the more recent decision in Gategroup Guarantee Limited: [2021] EWHC 304 (Ch) where Zacaroli J held that restructuring plans fall within the bankruptcy exception in Article 1(2)(b) of the Lugano Convention.

- There is nothing unjust or unfair to junior creditors in that approach. A similar technique was deployed in Re Tea Corp [1904] 1 Ch 12 and has been deployed in numerous subsequent schemes such as Re MyTravel [2005] 1 WLR 2365.

- Trower J noted (at [51]): “One aspect of this incremental development is that Part 26A has introduced an ability to bind a dissenting class where they have an economic interest in the company and are not therefore out of the money in the relevant alternative. However, where the evidence is that the members of the dissenting class are out of the money in the relevant alternative, and that their exclusion would in any event have been achievable if a Part 26 scheme had been proposed, it seems to me that their receipt of any benefits under the terms of the proposed Restructuring Plan means that they are unlikely to have been treated in a manner that is not just and equitable. Indeed, in such a case, section 901C(4) means that it may not have been necessary for such creditors to be summoned to a class meeting in the first place.”

![Brake & Anor v The Chedington Court Estate Ltd [2023] UKSC 29](https://southsquare.com/wp-content/uploads/2024/02/Brake-Anor-1-scaled.jpeg)